From time to time you send me questions regarding business in Poland. We usually talk about sole proprietorship (I’ve already described how to set it up here) or KRS companies, but sometimes we end up discussing the third possibility – business incubators and their pre-incubation scheme.

What are business incubators?

Business incubators are companies, foundations or public entities aiming to support entrepreneurship. There are several types of business incubators in Poland and their working methods differ. This text is focused on two institutions that provide pre-incubation country-wide: AIP and Twój StartUp.

Pre-incubation enables you to run your business without registration

The main goal of pre-incubation programmes is to enable fresh entrepreneurs to test their business ideas in a cheap and secure way, that is to start making money without any need to register a company or a sole proprietorship.

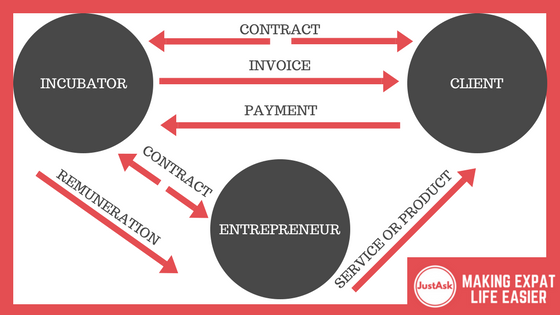

Business incubators simply rent their legal entities to their clients. It costs 250 PLN per month in Twój StartUp and 300 PLN in AIP. In exchange they give you a special bank sub-account and a web app to issue invoices on their behalf. You will also have access to limited monthly support from a legal department that will be responsible for preparing terms, contracts and other official documents for you. Because you’ll be using the incubator’s legal entity, contracts with your clients will be signed not by you, but by the foundation.

The foundation will teach you how to prepare invoices and civil contracts. They will also explain to you how to pay PIT, VAT and social and health insurance contributions, or they will do it for you. They will allow you to operate on their behalf and build your own brand using their legal entity.

During this time you will be employed by the foundation on the basis of civil contracts. This means that in case of registering in a voivodeship office you will apply for a temporary residence and work permit instead of a temporary residence permit for conducting a business activity. Find more on this topic later in this article.

You can leave the incubators whenever you want to

Neither AIP nor Twój StartUp has a minimum pre-incubation period. There is only a notice period of a month – so in the worst case scenario, if you decide to terminate your contract just after signing it, you will participate in the project for 2 months. There is also no maximum period – you can test your idea for as long as you want to. There are no income requirements. You only need to be able to pay a fixed monthly fee. If you don’t earn any money in a particular month, you can pay from your private funds. However, if you decide that it doesn’t make sense to keep your business open anymore, you will be allowed to close it with a notice period.

Business incubators are not charities…

.. and they need to sustain themselves from your payments. Łukasz Chrząsz, a Polish blogger, summarizes the pre-incubation scheme in the following way:

Simply stated, you pay for everything that you would need to pay for anyway if you had your own company, with the difference that these activities are carried out by the employees of business incubators for which you also must pay.

However, please remember that business incubators have already supported thousands of young entrepreneurs, so they know quite well how to provide the cheapest possible service on a sufficient level, often below market price. Thanks to the scale and corporate character of their services they can afford to cut costs and provide some key services within the basic package.

Two players in the game

There are two key business hubs with nationwide structures. Although they seem to be similar to each other, it’s worth contacting both of them and asking about the total monthly cost of the collaboration, including ZUS and PIT payments, because these amounts may vary considerably.

AIP

AIP was created in 2004. It was the final result of actions that have been undertaken since 1999 by Polish students who wanted to create a better environment for young entrepreneurs. The project is managed by the central foundation which aims at building and coordinating local structures at Polish universities. Local AIP structures are supported and supervised by academic authorities. AIP claims to have 50 offices incubating 1,600 startups. According to the organization, since the beginning 7,000 startups have successfully terminated the pre-incubation period and registered their regular legal entities (source).

In order to join AIP you need to contact their local structures at any of the universities, make an appointment for a meeting and sign a contract. Unfortunately they don’t have proper English websites.

Twój StartUp

Twój StartUp is independent from academic societies. It’s meant to be a cheaper and easier alternative to sole proprietorship.

In order to join Twój StartUp you need to contact their branch (it doesn’t need to be located within your city), make an appointment for a meeting, and sign a contract.

Advantages of business incubators

It’s easier to start

Business incubators are a good solution for people who have just started learning how to run a business in Poland. If you cannot tell the difference between the contract of mandate and the contract for specific work, don’t understand how to pay your PIT advance payments and ZUS contributions, don’t fully get a concept of VAT, cost and purchase invoices, or the costs of earning revenue, you may appreciate the fact that most of these things will be taken care of or explained by someone else and most of your financial documents will be double-checked. Although business incubators still require lots of self-reliance from you, you will have people willing to help you, which is quite comfortable when you don’t know or cannot afford reliable lawyers and accountants.

Legal and accounting support

Speaking of lawyers and accountants, the important part of the pre-incubation scheme is that you should have access to professional help. Both AIP and Twój StartUp offer legal help of 2.5 hours per month, with the possibility to get more for extra payment. Unfortunately, legal departments work quite slowly. Although you may find the quality of their work pretty low, it’s always good at the beginning when you cannot afford a good lawyer.

Jump in, jump out

Business incubators make it relatively cheap and fast to validate your idea. You can start running your business a few days after signing a contract and then simply terminate the contract with a month’s notice period. Neither while opening nor closing your project you need to worry about contacting the tax office or ZUS on your own.

Registration of stay

With Twój StartUp you can apply for a temporary residence and work permit on the basis of your work for the business hub. It’s much easier and cheaper to register your stay on the basis of work than on the basis of running a business activity.

AIP representatives haven’t confirmed or denied that you can do the same thing as their client, so you will need to contact your local AIP manager in order to discuss this.

Easier to survive “lean” years

As a non-Polish speaker you probably won’t be able to run your own business without an accountant. Accounting offices for foreigners cost at least 200 PLN + 23% VAT for simplified accountancy (usually CEIDG) and 400-600 PLN + VAT for companies registered in the KRS register. This is only one of costs that you will need to cover every month. Imagine that you make little or no profit for several months. Business hubs enable you to effectively cut costs when you’re short on money.

No ZUS payments

You need to contact both AIP and Twój StartUp managers and ask them if it’s required to pay ZUS contributions in your case. If it’s possible in your branch to use only contracts for specific work or you’re a student up to 26 years old, you will be able to legally earn money without paying ZUS insurance contributions.

No track of business activity

Many grants for young entrepreneurs require that the beneficiaries don’t conduct any form of legal activity for some period prior to their application. When you participate in the pre-incubation scheme, you’re technically not an entrepreneur and you’re not registered anywhere. This way you can first build and validate your business and then apply for a grant. It’s much better than taking a loan from the EU in the dark.

Disadvantages of business incubators

Slow legal and accountanting departments

New entrepreneurs need to be fast and flexible. It’s important to be able to quickly sign your contracts, withdraw money, pay for invoices or issue new invoices. Business incubators cannot afford to provide their clients with this kind of quick support. You will wait for legal document from 5 days to even over a month. It also takes several days to have your bank transfers approved.

All decisions are up to the foundation

All contracts will need to be signed by your manager. This is quite embarrassing when you have several clients and you want to look professional and reliable, but you need to explain each of them why you don’t sign your contracts on your own.

If you know that you will sign many contracts of a single type, make sure to ask your manager if it’s possible to grant you with power of attorney to sign them on behalf of the foundation. It’s often allowed in Twój StartUp.

Self-reliance

Although staff members of incubators do their best to help their clients, it’s obvious that for this kind of revenue they cannot afford to provide you with full assistance at the beginning of your business activity. You will be required to learn quickly and show lots of self-reliance, which is quite challenging when you don’t speak Polish and don’t know the system.

Incubators for foreigners

Most foreigners can join the pre-incubation programme

EU citizens

Citizens of other EU member states can participate in the pre-incubation programmes in the same way as Polish citizens.

Non-EU citizens

Non-EU foreigners have to meet additional legal requirements regarding legal stay on the territory of the European Union and work on a basis of civil contracts.

If a non-EU citizen has full access to the labour market without the work permit’s requirement (for example due to permanent residency, long-term EU residency, marriage with a Polish or an EU citizen, visa or a residence permit for studies, or Polish university degree), he or she is allowed to participate in the programme.

If a non-EU foreigner doesn’t have access to the labour market and needs work permits for each job position, the situation is a little bit more complicated:

- Twój StartUp claims that they accept expats who need work permits and they provide all the necessary legal documents for temporary residence permits, work permits and declarations of the intention to entrust a job to a foreigner.

- AIP representatives couldn’t provide me with any answer for this question. That means that you will need to ask your local AIP manager if they will accept you.

Multiple contractors or one contractor only

In both incubators you can either provide services to multiple economic operators, or work only with one particular operator. For example, if you’re a language teacher and your school prefers B2B contracts over regular employment forms, you can join the incubator and work only for one contractor for as long as you want.

On the other hand, you have it easier to work for several clients as a non-EU citizen, because you will have still only one employer – the foundation – which makes it easier to deal with the work permit’s requirement.

Regular employment positions and incubators

You are allowed to participate in the pre-incubation programme even if you have a regular job in a third company. You cannot join AIP if you are registered in the CEIDG register or if you are a company’s shareholder or an executive board member. Twój StartUp accepts also company owners and registered entrepreneurs

Not all types of services are accepted

When you rent the foundation’s legal entity, you cannot provide some services in high risk branches like the finance, construction and food industries, or insurance and transport sectors. There can be also problems with regulated or licensed professions. Contact AIP and Twój StartUp managers in order to discuss your profession.

Full cost of running a business with incubators

Okay, if you’ve come this far then you’re probably interested in joining one of the incubators and you want to learn the full costs. This is going to be a little bit complicated, but it will make sense eventually. I will show you the general rules of the system, but in fact the final cost of your business activity and your net remuneration will depend on the type of contracts that you will be allowed to use. Your manager will help you decide if you can cut costs on VAT, PIT or ZUS, so make sure to contact them in order to calculate the final cost of your enterprise.

| VAT | 23%

or not VAT |

| Monthly charge | 250 PLN or 300 PLN |

| PIT | 14.4% or 9% |

| ZUS | 1. Full ZUS, or 2. Only health insurance, or 3. No ZUS |

Foundations are registered as VAT taxpayers

When you want to charge someone 1,000 PLN, they will actually need to pay you 1,230 PLN because of the 23% tax. Every month the accountancy department will take VAT money from your sub-account.

There is a list of services exempt from VAT, for example teaching of foreign languages, psychological counseling or massage treatment. Ask your manager if you must pay it for your services.

Monthly charge

You need to pay a monthly fee: 250 PLN for Twój StartUp and 300 PLN for AIP. If that money is already inside the organization, it can be easily moved from one sub-account to another, but if you make no profit and would like to pay from your private account you need to count in VAT: 307.50 PLN for Twój StartUp (250 PLN + 23%) or 369 PLN for AIP.

Anyway, let’s say that you’ve earned enough money. You’ve paid your monthly charge and now you want to take your profit out. You will use civil contracts to do so.

Civil contracts

In order to transfer money from the incubator to your private account you will need to generate a civil contract between you and the foundation. There are the following options:

- contract of mandate for a student up to 26 years old

- contract of mandate with full ZUS

- contract of mandate for those who have the right to social insurance on the basis of another employment relationship

- contract for specific work (cost of earning revenue: 20%)

- contract for specific work with copyright transfers (costs of earning revenue: 50%)

Basically a contract of mandate is used to regulate an activity itself (even if there’s no result), and a contract for specific work has some tangible outcome: a report, a book, a piece of art, a piece of code.

The choice of a contract is very important because it impacts ZUS contributions and personal income tax, but it depends on the type of your services or products. In the best case scenario you can cut your PIT to 9%, and ZUS payments to 50 PLN or 0 PLN per month. Make sure to contact your manager in order to discuss it.

Contract of mandate for a student up to 26 years old

Students who haven’t reached the age of 26 years do not pay social and health insurance contributions for contracts of mandate. So in this case you will only pay PIT.

As you may remember from my previous articles, there are two PIT percentages for private persons: 18% and 32%. As for now forget about 32%. You will pay 18% of PIT advance payments from your income from each of your employers or contractors. But income doesn’t equal revenue. In order to calculate your income you need to deduct the costs of earning revenue. In this case it’s a fixed share for all taxpayers: 20% of revenue. So your income equals 80% of your revenue. 18% * 80% * x = 14.4% x — this is your income tax.

So when you want to transfer money from your incubator’s account to your private account and you transfer 1,000 PLN, there will in fact be two transfers:

| Gross remuneration on the contract | 1,000 PLN | |

| Personal income tax (14.4%) | 144 PLN | goes to the tax office |

| Net remuneration | 856 PLN | goes to your private account |

| ZUS (social and health insurance) | 0 PLN | |

| Total cost | 1,000 PLN |

Contract of mandate with full ZUS

If you’re not a student up to 26 you and you want to work on the basis of a contract of mandate you will need to pay ZUS contributions. If you read my article about old-age pensions than you probably remember that the costs of ZUS contributions are split between employers and employees: some part of it was paid from your pay-out, and your employer paid the other part from the company’s budget. However, in this case you will need to cover all of it, because the foundation is only lending you their legal entity. That’s why the total cost of the transfer will be higher than the gross remuneration on the contract.

| Gross remuneration | 1,000 PLN | |

| PIT and employee’s ZUS part | 271.76 PLN | |

| Employer’s ZUS part | 153.90 PLN | |

| PIT and ZUS together | 425.66 PLN | goes to ZUS and the tax office |

| Net remuneration | 728.24 PLN | goes to your private account |

| Total cost | 1153.90 zł |

In this scenario 1153.90 PLN disappears from your sub-account and 728.24 PLN goes to your private account.

Contract of mandate for those who have the right to social insurance on the basis of another employment relationship

People who have another job and earn a minimum monthly wage (2,000 PLN in 2017) don’t pay social insurance contributions for additional contracts of mandate. Only health insurance contributions. Health insurance is fully covered by employees. That means that employers don’t pay any part of it from the company’s budget, so the gross remuneration of the contract equals the total cost.

| Gross remuneration | 1000 PLN | |

| PIT and employee’s ZUS part | 157 PLN | 67 PLN for PIT, 90 PLN for health insurance |

| Employer’s ZUS part | 0 PLN | |

| PIT and ZUS together | 157 PLN | goes to ZUS and the tax office |

| Net remuneration | 843 PLN | goes to your private account |

| Total cost | 1,000 PLN |

Contract for specific work

Contracts for specific work look similar in practice to the contract of mandate for students: there are no ZUS contributions and you deduct the 20% cost of earning revenue, so in fact you pay only PIT: 14.4%.

| Gross remuneration on the contract | 1,000 PLN | |

| Personal income tax (14.4%) | 144 PLN | goes to the tax office |

| Net remuneration | 856 PLN | goes to your private account |

| ZUS (social and health insurance) | 0 PLN | |

| Total cost | 1,000 PLN |

Contract for specific work with copyright transfers

If you’d like to pay yourself for:

- original graphic projects (logo, website’s layout)

- original training projects prepared only for only one particular training subject

- original music, photography, scenic, or audiovisual projects

- original programming projects

- original tools and materials for language learners

and you transfer copyrights or issue a licence to the buyer, you can use 50% of the costs of earning revenue, so you will pay only 9% for your personal income tax (50% * 18% * x).

| Gross remuneration on the contract | 1,000 PLN | |

| Personal income tax (9%) | 90 PLN | goes to the tax office |

| Net remuneration | 910 PLN | goes to your private account |

| ZUS (social and health insurance) | 0 PLN | |

| Total cost | 1,000 PLN |

Find out more

Take a look at my Business in Poland section and read about sole proprietorship registration in the CEIDG.

Sources

Wikipedia: Inkubator przedsiębiorczości

thanks maciek

I got a new way to run business after reading your article!

Hey Lucas, thank you for staying with JAP!

Thanks so much, this has been very helpful. I received a (b2b) offer from a company in poznan and I was a bit confused as I had no idea how it works. Which would you say is cheaper/better at the end b2b or the normal contract?