If you’re a long-time expat you’ve surely come across ZUS already. If you’re new here and you want to work, you will get familiar with them quite soon. They will send you a letter in which they will mention three things: Open Pension Funds, property relationships with your spouse and your pension sub-account. The aim of this article is to explain what you need to know about the Polish pension system in order to understand their letter and what you’re supposed to do when you receive it.

Out of sight, out of mind – how much does your work cost?

Most of my readers are employed under an employment contract. You already know the differences between your net and gross salary. Take a look at your gross salary and please check what percentage of it goes to public institutions.

| Employee | Employer | |

| old-age pension insurance | 9.76% | 9.76% |

| disability pension insurance | 1.50% | 6.50% |

| sickness insurance | 2.45% | – |

| health insurance | 9% * (gross salary – social insurance contributions) | – |

| work accident insurance | – | 1.80% |

| Labour Fund | – | 2.45% |

| Fund of Guaranteed Employee Benefits | – | 0.10% |

| Old-age Bridging Pensions Fund (if applies) | – | 1.50% |

| + personal income tax |

That means that if you have an employment contract and you earn 2,000 PLN gross, you get 1,459.48 PLN directly and you cost your employer 2,412.20 PLN. If your gross salary is 4,000 PLN, you get 2,853.96 PLN net and your work costs 4,824.40 PLN. For 6,000 PLN gross it will be 4,247.43 PLN net and 7,236.60 PLN of the employment total cost.

Old-age pensions cost the most

Excluding personal income tax, the biggest part of your income goes to old-age pension insurance contributions. It’s 19.52% of your gross salary that you pay together with your employer every month – you pay 9.76% that’s taken from your payout, and your employer gives the additional 9.76% from the company’s budget. We’re talking about the following amounts of money:

| Gross salary | Monthly old-age pension insurance contributions |

| 2,000 PLN | 390.40 PLN |

| 4,000 PLN | 780.80 PLN |

| 6,000 PLN | 1,171.20 PLN |

That means that if you work in Poland for 5 years and earn 4,000 PLN gross, you will invest 46,848 PLN in your future old-age pension. What happens to this money?

Polish pension system: What is ZUS?

In the beginning it goes to ZUS – the Polish Social Insurance Institution (Zakład Ubezpieczeń Społecznych). This is one of the biggest public institutions in Poland, established in 1934. It plays a major role in the entire Polish social security system since the reform of 1999. Their main task is to take care of your old-age pensions, but they also manage, control or pay benefits like sickness, maternity, carer, and compensatory benefits, disability and survivor’s pensions, or funeral grants.

You can read about all of them in the excellent info brochure prepared by ZUS itself a year ago. The editor, Mrs. Anna Pątek, did an amazing job. The brochure is very informative, clear and translated to perfect English by Mr. Guy Torr. I definitely suggest that you read it, as it describes the entire Polish social security system, including all forms of financial support that you can expect from the government.

The letter

Before I start explaining the system, please let me translate the letter that you receive from ZUS within half a year after you start working in Poland for the first time. I’m pretty sure that in the beginning you won’t understand what they’re talking about but it will help you catch the sense of this article and my further explanations.

Wezwanie do złożenia oświadczenia o stosunkach majątkowych istniejących między ubezpieczonym a jego współmałżonkiem – Request for completion of declaration on property relationships between the insured person and their spouse.

Szanowna Pani/Panie

Po ostatnich ustawowych zmianach dotyczących przynależności do II filaru emerytalnego może Pani/Pan zdecydować, czy część składki emerytalnej w wysokości 2,92 proc. przekazywać do otwartego funduszu emerytalnego (OFE), czy też zapisywać ją na subkoncie w ZUS.

Dear Sir or Madam

After the recent changes in the law on the affiliation of the second old-age pension pillar you can decide if part of your social pension contribution in the amount of 2.92% will be transferred to an open pension fund (OFE), or recorded on the special ZUS sub-account.

Podkreślić należy, że środki zgromadzone na subkoncie mogą podlegać podziałowi – w razie rozwodu, unieważnienia małżeństwa albo być odziedziczone przez najbliższych w przypadu śmierci osoby, dla której Zakład prowadzi subkonto – na takich samych zasadach jak środki zapisane w OFE.

It should be pointed out that funds recorded on the sub-account can be distributed – in the event of divorce or marriage annulment, or be inherited by those closest to a person in case of death of a person who has a sub-account in ZUS – on equal terms with the financial means deposited in the open pension funds.

Dlatego każdy ubezpieczony, który zdecydował się ulokować w ZUS część składki, o której mowa powyżej i tym samym, w ciągu czterech miesięcy od powstania obowiązku ubezpieczeń (czyli podjęcia działalności gospodarczej albo pracy na podstawie umowy o pracę lub umowy cywilno-prawnej itp.) nie zawarł umowy z OFE, musi złożyć w Zakładzie Ubezpieczeń Społecznych oświadczenie o stosunkach majątkowych ze współmałżonkiem oraz może jednocześnie wskazać osoby uprawnione do otrzymania środków z subkonta po śmieci ubezpieczonego. Umożliwi to odziedziczenie środków zgromadzonych na subkoncie przez wskazane osoby.

Thus every insured person who has decided to dispose the above mentioned part of the social insurance contribution in ZUS and thereby within four months since the social insurance chargeable event (that is, since undertaking the economic activity or employment under a contract of employment or a civil contract and so on) hasn’t concluded a contract with OFE, must submit the declaration on property relationships between the insured person and their spouse in the Social Insurance Institution and can also indicate the persons entitled to the receipt of funds from the sub-account after the insured person’s death. This will enable the indicated persons to inherit the funds recorded on the sub-account.

W związku z powyższym Zakład Ubezpieczeń Społecznych uprzejmie prosi o dostarczenie następujących dokumentów:

- “Oświadczenie ubezpieczonego o stosunkach majątkowych istniejących między ubezpieczonym a jego współmałżonkiem” – w przypadku pozostawania w związku małżeńskim”,

- “Wskazanie/zmiana osób uprawnionych do otrzymania środków zgromadzonych na subkoncie ubezpieczonego” – w przypadku podjęcia takiej decyzji.

Obydwa formularze dostępne są na www.zus.pl oraz w kazej placówce ZUS.

Dokumenty można złożyć:

- bezpośrednio w sali obsługi klientów w dowolnej placówce ZUS,

- za pośrednictwem poczty, wysyłając do dowolnej placówki ZUS (adresy dostępne są na www.zus.pl).

In view of the above the Social Insurance Institution kindly requests the following documents:

- Declaration on property relationships between the insured person and their spouse – if the insured person is married;

- Indication/change of the persons entitled to the receipt of funds from the sub-account – if such a decision is made.

Both forms are available online on www.zus.pl and in every ZUS branch.

The documents can be submitted:

- directly in the customer service center at any ZUS branch;

- via post sent to the address of any ZUS branch (addresses are available on www.zus.pl).

Dodatkowe wyjaśnienia oraz pomoc przy wypełnianiu formularzy można uzyskać w każdej placówce ZUS oraz za pośrednictwem Centrum Obsługi Telefonicznej, tel. 801 400 987, 22 560 16 00 (czynne od poniedziałku do piątku w godzinach od 7:00 do 18:00), wybierając jako temat romowy z konsultantem opcję “Informacje dla ubezpieczonych”.

Additional explanations and help with filling out the forms can be obtained in any ZUS branch and through the Phone Support Center, tel. 801 400 987, 22 560 16 00 (from Monday to Friday between 7:00 and 18:00), choosing the “Informacje dla ubezpieczonych” option as the topic of the conversation with a consultant.

How does the Polish pension system work?

There are many pension schemes for people of different ages, but we will focus only on the current system – for people born after 1968 – after its modification in 2014. If you started working in Poland before July 2014, or if you were born before 1968 you should consult your case with ZUS clerks.

In a nutshell

Monthly old-age pension insurance contribution equals 19.52% of your gross salary.

12.22% will always go to ZUS.

You have 7.30% remaining. You can either send the full amount of 7.30% to the special ZUS sub-account, or decide to choose Open Pension Funds (OFE). If you go for OFE then:

- 4.38% will go to the special ZUS sub-account anyway

- 2.92% will go to OFE

I know it’s strange. I will explain why it works like this later on.

There is no real money in ZUS

There is no real money in your ZUS account and sub-account. Everything that ZUS gets from you is spent on current old-age pensions. It’s called “solidarity between generations” – you pay for current pensioners, and your children and grandchildren are supposed to pay for you. That means that your funds recorded in ZUS are virtual – it’s only a promise that the country will pay you money in the future.

Will it pay though? The system is already inefficient. There are too few working people to pay current pensions and there are going to be fewer. The prospects are that from this year to 2021 the system will have a 50 billion deficit annually (source). Young Poles are said to not rely on their future pensions. However, participation in the system is obligatory.

Why you need to decide between OFE and the ZUS sub-account

Back in 1999-2010 there was no ZUS sub-account and people had only ZUS and OFE. The difference was that ZUS was public and kept virtual deposits, and OFE were managed by private companies that really kept the money of their members in the form of investment capital. According to this idea people were meant to get their pensions from two obligatory systems: a public one and a private one. In the public one their future pensions would be paid by the next generations, so the risk was that the system would eventually collapse because of demography. In the private one pensions were meant to come from the collected capital and investment profits, but the risk was that the company would take losses in investment.

First in 2011 and then in 2014 the government changed the system and introduced ZUS sub-accounts. They did this because they needed some quick solution for a ZUS deficit without introducing unpopular pension reforms. By moving capital from private funds to a public system they made them ‘virtual’ – they could spend that money on current pensions and promise people that future generations would pay them their extra money taken from OFE as well. As a result of the changes 7.30% of your salary that was previously transferred to private funds (OFE) can be now:

- either sent only to the ZUS sub-account

- or divided:

- 2.92% to OFE

- and 4.38% to the special ZUS sub-account.

Does it sound like cheating? Imagine being in Poland when they introduced this reform and did everything to convince people to choose ZUS sub-accounts only. It was a huge public debate and a very controversial political action processed in a terrible manner. As a result of the government’s actions 85% of people decided to have only ZUS and stopped paying to OFE companies.

Now all insured people have ZUS accounts and sub-accounts. There are a few differences between those two, and the most important one is that money from sub-accounts can be inherited or divided same as OFE capital, whereas a regular ZUS account doesn’t have this option.

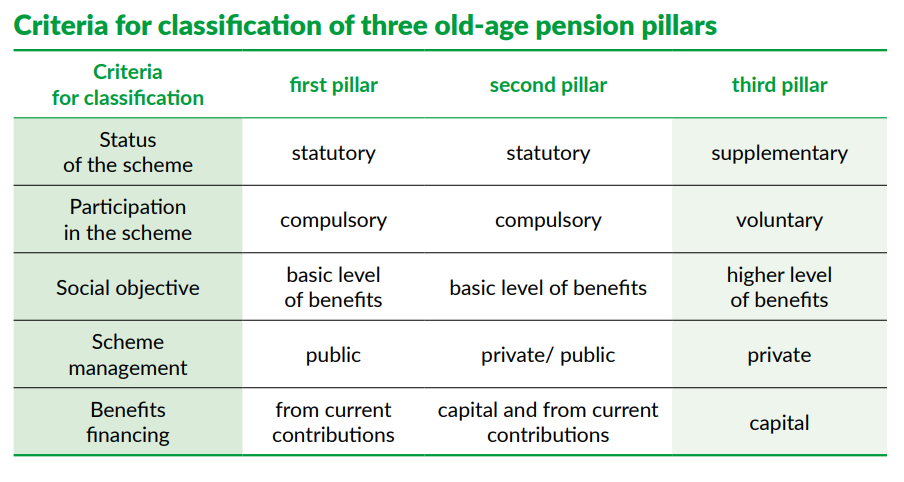

You’ve just learned about the two obligatory pillars of the Polish pension system. Let’s go over it once again using the pillar scheme.

The current old-age pension system consists of three pillars

As we discussed above, although in practice you don’t need to care where your old-age pension contributions go, it’s good to know that they’re in fact divided between two obligatory pillars. You can also participate in the third pillar on a voluntary basis.

- The first pillar is managed by a public institution – ZUS

- The second pillar now has two parts:

- Open Pension Funds – OFE (managed by private companies)

- special sub-account in ZUS (public)

- The third pillar is voluntary and managed only by private companies

Polish pension: Criteria for classification of three old-age pension pillars | Source: Social Security

in Poland, edit. Anna Pątek, transl. Guy Torr, Warsaw 2016, p. 55, link.

First pillar – the easiest one

The first pillar is managed by ZUS only. Money from your contributions is virtual – it’s spent on current old-age pensions. You won’t see it anymore, but all your contributions are recorded and will have impact on your pension if you decide to take it in Poland, EU member states or other countries collaborating with Poland in the matter of old-age pensions (this topic deserves its own article that I will surely write if you stay with me and help JAP grow). In fact the more and longer you pay, the higher your pension should be.

Second pillar – you need to choose between private and public funds

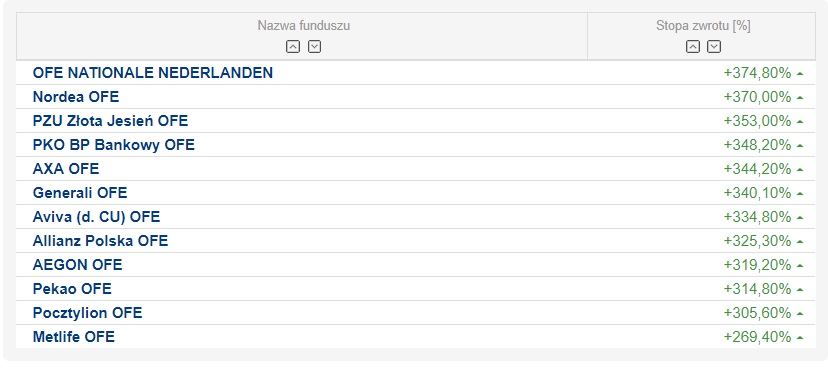

The second pillar is made up of two parts: Open Pension Funds and a sub-account in ZUS. The Open Pension Funds (OFE) are managed by private institutions – General Pension Societies (PTE). Right now there are 12 such companies that you will find later in this article.

Currently a ZUS account and ZUS sub-account are obligatory, but people who start working in Poland for the first time may choose whether they want to send some part of their contributions (2.92% of their gross salary) to an OFE company, or whether everything (7.30% of their gross salary) should go to the special ZUS sub-account. Their decision can be changed within the next transfer window that will be open in 2020, from April to June, and then again and again every four years – except for the fact that the current government wants to finally close the second pillar in 2018 (you will find more information on it later in this article).

Third pillar

The third pillar is voluntary and administered by private institutions. It’s recommended that you sign up for it and pay them supplementary contributions in order to provide yourself with a higher lever of old-age pensions. This pillar is not important for our current topic so I won’t describe it, but you can find the exhaustive description in the ZUS brochure that I mentioned. It’s enough to say that the third pillar consists of:

- Occupational Pension Programmes (Pracownicze Programy Emerytalne, PPEs)

- Individual Old-age Pension Account (Indywidualne Konto Emerytalne, IKE)

- Individual Old-age Pension Protection Account (Indywidualne Konto Zabezpieczenia Emerytalnego, IKZE).

Ok, so what do they want from you in the letter?

In the letter they ask you to do three things:

- decide whether you want to send all your contributions from the second pillar only to the ZUS sub-account, or if you want to divide it between OFE and the ZUS sub-account;

- provide them with the data of your spouse if you’re married and if you chose a ZUS sub-account;

- provide them with the data of the person entitled to inherit your ZUS sub-account money if you want to choose anyone.

ZUS or OFE?

I’m almost sure that you cannot choose between ZUS and OFE anymore. Why? If you’d like to go for OFE, you have 4 months after your employer enters you into the insurance system to sign a contract with an OFE company and inform ZUS about this fact. The point is that ZUS sends their letters after this 4 months period (at least in my case they did it). You may ask why you couldn’t see any adverts of OFE earlier. Back in 2014 OFE companies were banned from advertising their services in order to keep them quiet when the government urged people to choose ZUS only (source).

However, if you can still make a choice and you would like to send some of your money to OFE, you should sign a contract with one of the companies and send a special form to ZUS after that.

Which one should you choose? I’m not an expert in this field so I will only repeat the insights of Marcin Iwuć, a popular Polish blogger and finance consultant, from this Polish article from 2014.

Better financial results

Depending on your choice, the seize of the part of your future pension will depend either on the level of valorisation of your virtual money in ZUS or on the investment performance of OFE. Many say that capital in OFE is subject to market risk so falls in stock-markets will result in your losses. Marcin Iwuć confirms that it’s true, but he points out that in the long term you should have some profit. Please check this chart presenting the rate of return from the beginning of OFE to 2.08.2017 according to Money.pl.

The ZUS sub-account is reassessed on the basis of the nominal GDP growth for the last 5 years. Many people claim that it’s much better than what you can have in OFE but Marcin Iwuć points out an important fact – the investment return rates affect real capital, and the valorisation rule operates only on recorded numbers, as there is no capital in ZUS. No one can guarantee that rules will be the same when you retire or that the future generations will be able to carry the burden of the current system’s promises. Most likely your retirement conditions will be much worse in these 20-40 years.

Guaranteed pensions

Polish pensions located in ZUS are guaranteed by the Treasury, whereas no one will guarantee that you will get the part of your money from OFE which are private institutions. Still, Polish demographic situation makes people skeptical about their guarantees. People say that the government guarantees your old-age pension but not it’s a sufficient amount, so it can get too small to live.

In the end everything goes to ZUS

I haven’t mentioned one sad fact yet. The government constructed a thing called “a security slide”. 10 years before you reach retirement age your OFE money will be slowly transferred to ZUS once per six months until all your money becomes virtual. It’s the next trick of the government designed to move more capital to ZUS and use it for current rents.

Which option will secure you a bigger pension?

Marcin Iwuć writes that in the end of the day your choice doesn’t make any huge difference. Politicians did their best to make sure that in both cases your pension based on two obligatory pillars would be comparable. Unfortunately in both cases it will be very low.

85% people didn’t choose OFE

It’s worth adding to the argumentation of Marcin Iwuć that after the changes from 2014 only 15.4% of insured people declared that they wanted to keep sending their money to OFE. 84.6% of people now send their full second pillar contributions only to the ZUS sub-account (source).

OFE will end soon

I also need to add that the system has been destabilized by the projects of the current government once again. There is no official description of projected changes but Gazeta Prawna is pretty sure that OFE will finally end in January 2018. The operation is scheduled to start on Monday, the 22nd of January, but the magazine admits that it may be rescheduled. On that day 25% of your capital from OFE shall be recorded on the ZUS sub-account.

What will happen to 75% of it? According to Gazeta Prawna, this money will be taken care of in February. OFE companies will be automatically moved to the third pillar. In practice that means that your OFE account capital will be changed into Individual Old-age Pension Protection Account (IKZE) capital. That is quite important, because money from IKZE can be taken of, contrary to money in OFE. However, there are rumors that the government is going to impose a huge tax on people who’d like to withdraw their OFE money after it is transferred to IKZE.

The project is still being determined.

Conclusion

The final answer depends on your individual situation. If you have time, you should contact OFE companies and look for further information that could convince you to sign a contract with them and send a form to ZUS. If not, don’t do anything and you will be automatically assigned only to ZUS. In most cases it won’t make a really big difference. 85% of Poles are already only in ZUS.

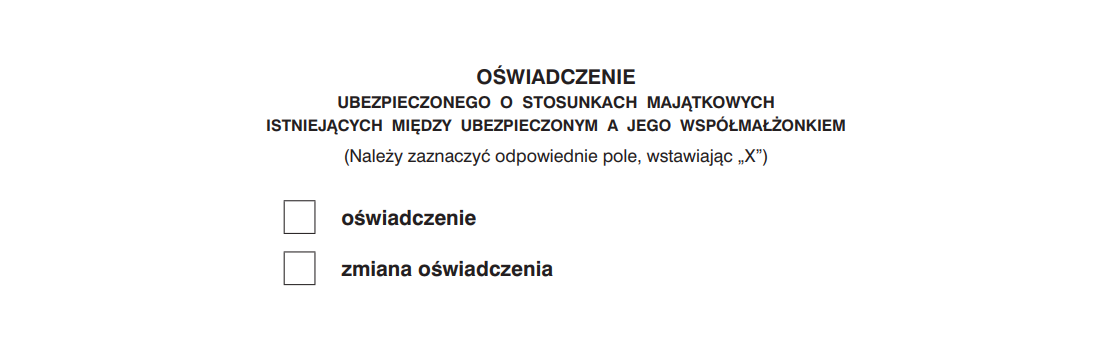

Declaration on property relationships between the insured person and their spouse

After all this time we’ve come to the point when I can finally tell you what forms you are expected to deliver to ZUS. Thank you for still being here.

Both forms are used for the proper division of your money. Money recorded on your ZUS sub-account can be divided in the event of:

- divorce

- marriage annulment

- cease of statutory joint property of spouses during marriage

- death of the sub-account’s owner

When you are an OFE member, your OFE company keeps all needed records and informs ZUS of how to divide the money. However, right now 85% of Poles have only ZUS so ZUS clerks need to know on their own who your spouse is and if you choose anyone to inherit your money. The first form is obligatory when you have a spouse but there are no penalties if you don’t submit it. The second one is voluntary. That’s why I will translate only the first form: Declaration on property relationships between the insured person and their spouse (click!). You can find the second, voluntary form here and fill it out with your Polish friends or ask the clerks in ZUS for help.

The second form, and old-age pension savings inheritance and distribution rules deserve their own article. Hopefully one day JAP will grow big enough to cover all these topics.

Oświadczenie ubezpieczonego o stosunkach majątkowych istniejących między ubezpieczonym a jego współmałżonkiem – Declaration on property relationships between the insured person and their spouse

(Należy zaznaczyć odpowiednie pole, wstawiając „X”) – check the box with the ‘X’ symbol

- oświadczenie – declaration

- zmiana oświadczenia – declaration’s amendment

I. DANE IDENTYFIKACYJNE – Identification data

01. Nazwisko – surname

02. Imię pierwsze – first name

03. Imię drugie – middle name

04. Data urodzenia (dd / mm / rrrr) – birth date (dd/mm/yyyy)

05. Numer PESEL (1) – PESEL number

(1) W przypadku gdy nie nadano numeru PESEL, należy wpisać serię i numer dowodu osobistego lub paszportu. – If a PESEL number hasn’t been issued, please write your ID card series and number or your passport number

06. Rodzaj dokumentu – Type of document

jeśli dowód osobisty, wpisać 1, jeśli paszport – 2 – write ‘1’ for an ID card or ‘2’ for a passport

07. Seria i numer dokumentu tożsamości: – series and number of the document

II. DANE ADRESOWE (1) – Address

01. Kod pocztowy – Postal code

02. Poczta – Post

03. Gmina / Dzielnica – Municipality/city district

04. Miejscowość – City

05. Ulica – Street

06. Numer domu – House number

07. Numer lokalu – Flat number

08. Numer telefonu (2) – Phone number

09. Symbol państwa (3) – Country abbreviation code

10. Zagraniczny kod pocztowy (3) – Foreign post code

11. Nazwa państwa (3) – Name of the country

12. Adres poczty elektronicznej (2) – E-mail address

(1) Jeżeli adres zamieszkania jest inny niż adres zameldowania – należy wpisać adres zamieszkania, natomiast jeżeli adres do korespondencji jest inny niż adres zameldowania i zamieszkania – należy wpisać adres do korespondencji. – If the actual address of residence is different than the registered address of residence – please write the actual address of residence, but if the correspondence address is different than actual or registered address of residence – please write the correspondence address.

(2) Podanie numeru telefonu i adresu poczty elektronicznej nie jest obowiązkowe. – Indication of the phone number and e-mail address is not mandatory.

(3) Wypełnić w przypadku gdy adres jest inny niż polski. – Fill out only when it’s not a Polish address.

III. OŚWIADCZENIE O STOSUNKACH MAJĄTKOWYCH UBEZPIECZONEGO ZE WSPÓŁMAŁŻONKIEM (1) (2) – Declaration on property relationships between the insured person and their spouse

1. Oświadczam, że między mną a współmałżonkiem istnieje albo istniała ustawowa wspólność majątkowa – I declare that there exists or existed between me and my spouse statutory joint property of spouses

TAK (3) – yes

NIE – no

(1) Dotyczy wyłącznie osób pozostających w związku małżeńskim – Applies only to married people

(2) Należy zaznaczyć odpowiednie pole, wstawiając „X” – Please check the box with the ‘X’ symbol

(3) W tym przypadku należy wypełnić część III – If you answered ‘yes’ please fill out part III

2. Informacja o sposobie uregulowania małżeńskich stosunków majątkowych. – Information on the marriage property consequences regulation

Data (dd / mm / rrrr) – Date (dd / mm / yyyy)

Powstanie ustawowej wspólności majątkowej od: – the origination date of statutory joint property of spouses:

Ustanie ustawowej wspólności majątkowej od: – the termination date of statutory joint property of spouses:

Inny sposób uregulowania stosunków majątkowych od: – the introduction date of another way of regulating property relationships between spouses:

Zgodnie z art. 39 ust. 1b ustawy z dnia 13 października 1998 r. o systemie ubezpieczeń społecznych (Dz.U. z 2013 r. poz. 1442, z późn. zm.) ubezpieczony może wskazać osoby, które w przypadku jego śmierci będą uprawnione do otrzymania środków zgromadzonych na prowadzonym dla ubezpieczonego subkoncie, o którym mowa w art. 40a tej ustawy. – According to Art. 39 par. 1b of the Act of 13 October 1998 on the social insurance system (Journal of Laws of 2013, item 1442 as amended) the insured person can indicate persons entitled to receive the means collected on the insured person’s sub-account referred to in Art. 40a of this act in the event of death.

Ubezpieczony, wypełniając niniejsze oświadczenie potwierdza prawdziwość i kompletność danych podanych w oświadczeniu i ponosi odpowiedzialność za skutki wynikające z podania nieprawdziwych lub niekompletnych danych. – By completing this declaration the insured person confirms that the declared information is honest and complete, and takes the responsibility of effects deriving from giving false or incomplete data.

W przypadku zmiany dotyczącej treści niniejszego oświadczenia należy każdorazowo dokonać zmiany oświadczenia – In case of a change concerning the content of this declaration one must always submit the declarations’s amendment.

(Miejscowość) – City

(Data: dd/mm/rrrr) – Date (dd/mm/yyyy)

(Podpis ubezpieczonego) – Signature of the insured person

Find more useful articles

You can find more useful articles on JustAsk Poland. I promise that not all of them are as long and detailed as the one that you’ve just read. Go straight to sections:

Sources:

ZUS – Social Insurance in Poland

Marcin Iwuć – Ile wpłacisz do ZUS

Gazeta Prawna – Koszty zatrudnienia pracownika

Sedlak&Sedlak – Kalkulator wynagrodzeń

Thank you very much for this article. This gives great clarity on the Polish system. Perhaps you could elaborate further on the possibility of transfering this pension contribution to another country. As many expats might not stay in Poland until retirement. What options do they have to transfer this money to another pension fund?

Hello Marelke, thank you for your comment and for suggesting me an important topic. I’ve already contacted the press secretary of ZUS in order to confirm the results of my research on old-age pensions for people who change countries of living. I will do my best to publish an article about this in September at the latest.

Hi Maciek

Thanks a lot you post this useful article ! I also would like to know about this pension contribution for expats (non EU citizen) who might not living in Poland on their old-age pensions (example if they back to their origin country (non EU countries)). What will be happen with their Polish Pension ZUS, disappear or they can claim later

Hey Maya! I’m currently working on this topic and hopefully I will publish it in September at the latest 🙂

Hi Maciek, I got an urgent question regarding the pension benefits. My colleague called ZUS and asked about the pension entitlement in case I leave Poland, and surprisingly, he was told I will not get any pension even if I retire in Poland because I am from a country which is neither EU member state nor has a bilateral agreement with Poland (I am from China, btw). If what the ZUS helpline said is true, I would be really astonished that Polish pension is tied to a person’s citizenship. Do you know anything about this? I’d appreciate your response.

Hello Yan. This is more complicated and I need to know more about your biography and future plans before I answer, so I’ve sent you an email message.

As a non-EU person, I am really curious about this too, since I’m leaving Poland for Switzerland soon.

This article is taking me definitely too long. Please contact me at [email protected] and we’ll solve your case before I’ll publish an article.

Hi Maciek, once again thank you for the article, very well written! I would like to ask you if you plan in the future to write about taxes for self-employed people. I imagine that within your followers, this might be a very small percentage though. This domain is not my strong point and it is quite difficult to find details in English about it: ZUS, pension, NFZ, maternity, how are all this calculated in the case of a private owned business (spółka cywilna to be more exact)? If you can manage to put together some info on this in the future, I would very much appreciate it:)

Hi Iulia, thank you for your feedback 🙂 There will be some articles for B2B contractors but probably none of them will answer all your questions. However, I also offer paid research reports for my concierge clients tailored to their needs and specific situation. Please send me a message to [email protected] if that interests you.

Hi Maciek,

This is a wonderfully written article. Very useful for the expats the way you have detailed. Even though it’s very discouraging, as the saying goes truth is always bitter 🙂 just kidding. I had this letter for a long time with me and not knowing what to do with it.

I recently read a article on your FB regarding the residence application for non-EU residence. Would you be okay if I write to you for some clarifications?

Regards,

Prasannah

Hello Prasannah, thank you for your kind words and for joining JAP :). Please feel free to contact me at [email protected]

I was just about to send you an email regarding this… I’m glad I checked first! 😛

Thanks a lot for such a enlightening article!

Uff, imagine how long would my answer be 😉 thank you for staying around, Daniel

Hello Maciek,

I am very keen to know, what was your answer to Yan’s question. I was about to ask the same question. 🙂

Thanks in advance !

Fantastic article, thank you for all your insights.